The future of digital banking where customers can interact with your bank as naturally as chatting with a friend. No menus, no apps, no technical hurdles just smooth conversations in any language, anytime.

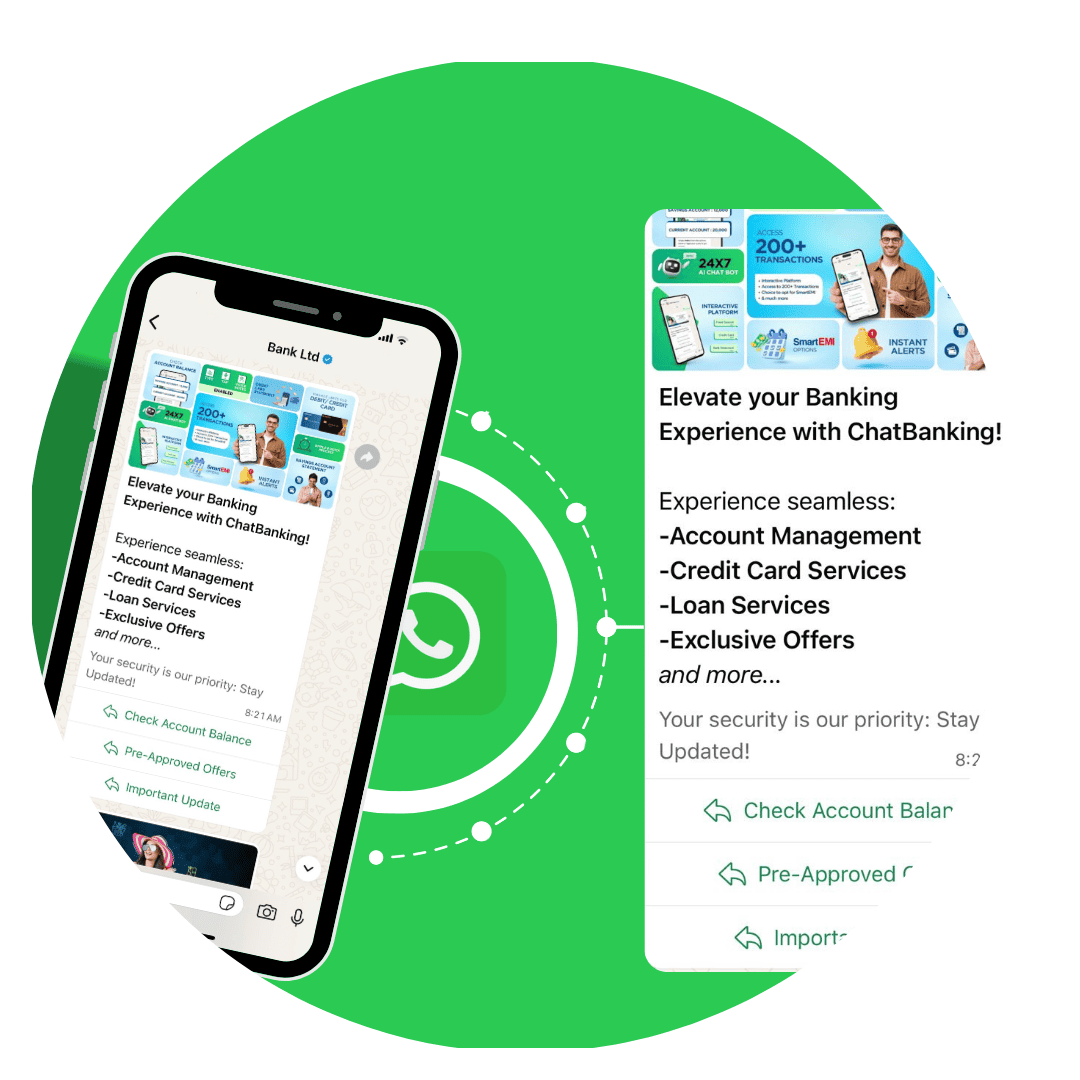

Our WhatsApp Banking Suite combines conversational AI, instant onboarding, and round-the-clock security—delivering a seamless, customer-first banking experience right inside WhatsApp.

Banking feels like chatting with a friend. Customers can ask questions in plain language, switch between English or regional languages anytime, and get quick, natural responses without menus or apps.

From applying for a credit card to getting a vehicle loan, the suite guides customers step by step. With instant ID verification, OTP security, and real-time eligibility checks, applications are completed in minutes inside WhatsApp

Available round the clock, the assistant remembers conversations and provides context-aware replies. Built with end-to-end encryption and fraud protection, it ensures safe, reliable, and human-like banking anytime, anywhere.

A small river named Duden flows by their place and supplies it with the necessary regelialia. It is a paradise

Send a simple WhatsApp message: “Hi, I want to check my balance” or “I need a credit card.”

I identifies the intent (balance, card, loan, etc.) and secures access with OTP if required.

Upload ID or documents directly in chat. AI verifies instantly.

Credit card requests → fetches credit score + eligible cards.

Loan requests → checks eligibility, shows options.

Account queries → fetches real-time backend data.

Customer selects the best option → AI processes the request → approval/confirmation delivered inside WhatsApp.

Offers smart, AI-powered features to make banking simple, fast, and seamless—handling queries, transactions, and services directly within WhatsApp.

Customers can ask anything, like account balance or recent transactions. The AI understands natural language and responds instantly with human-like accuracy.

Request a new card, upload your ID, verify with OTP, and explore card options. AI checks eligibility, recommends the best cards, and submits applications instantly.

Apply for a car loan by sharing vehicle details and ID. The AI provides instant eligibility checks, EMI breakdowns, interest rates, and tracks your application—all within WhatsApp.

Supports English and multiple regional languages (Hindi, Malayalam, Tamil, Urdu, and more). Customers can switch languages mid-chat, with AI adapting to dialects naturally.

Provides round-the-clock banking help with context-aware replies. The AI remembers ongoing conversations and works smoothly even on low bandwidth.

Every interaction feels personal and responsive, ensuring fast, accurate, and seamless customer experiences anytime, anywhere.

No. Customers can simply use their existing WhatsApp to chat with your bank.

It uses WhatsApp’s end-to-end encryption along with OTP authentication and real-time ID verification for maximum security.

Yes. Customers can use English, Hindi, Malayalam, Tamil, Urdu, or other regional languages—even switching mid-conversation.

From checking balances and transactions to applying for loans and cards, customers can handle almost all retail banking services via WhatsApp.

Yes. Customers can instantly block, unblock, or manage their cards by simply typing a request in chat.

Yes. The WhatsApp Banking Suite can be tailored with your bank’s products, services, and workflows to ensure a branded, seamless experience.

It connects securely with your core banking systems, CRM, and APIs to fetch and process data in real time.

Absolutely. The system is cloud-ready and designed to handle high volumes of customer interactions simultaneously.